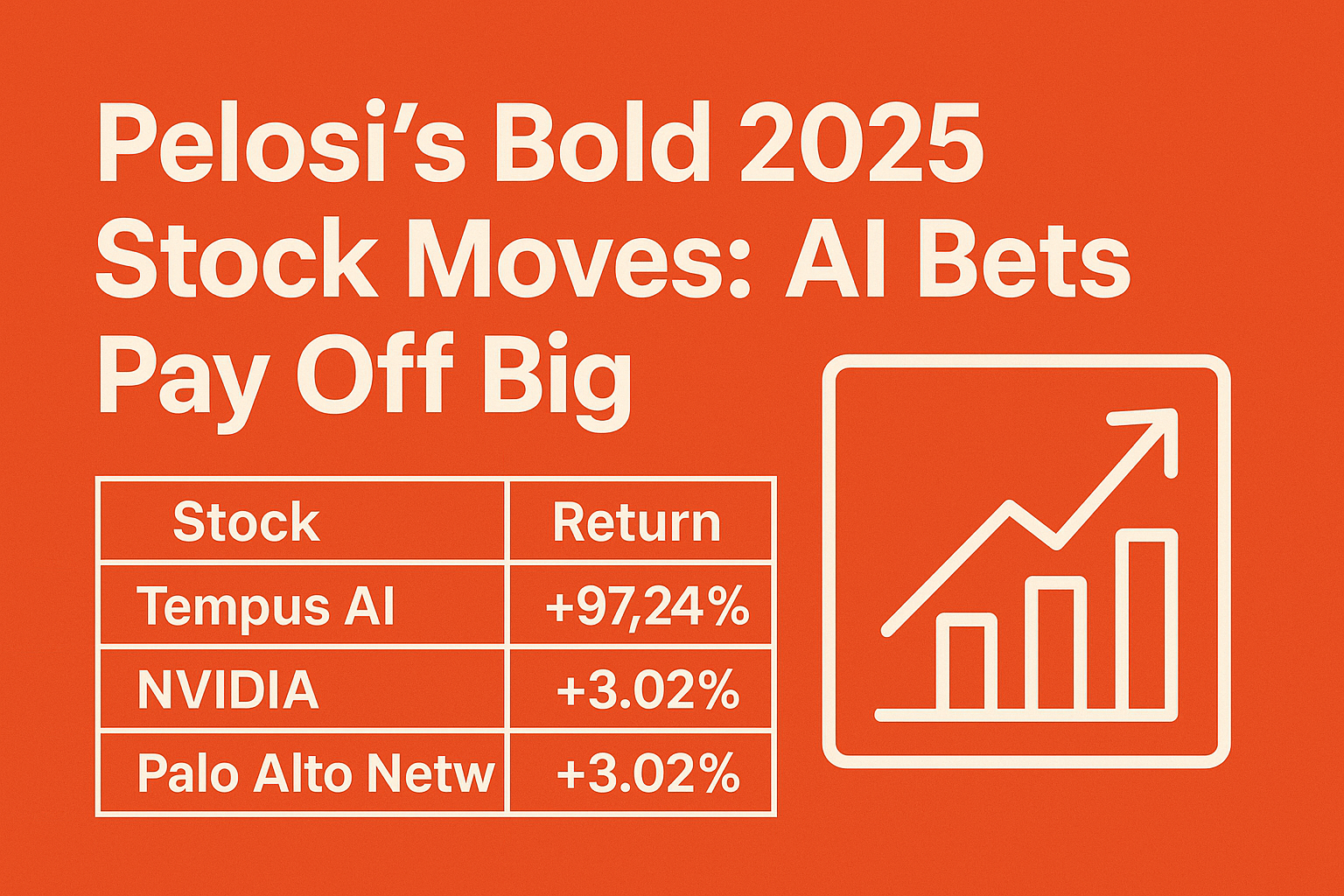

Nancy Pelosi’s 2025 stock trades show strong gains in AI and tech. Discover which stocks surged, her top holdings, and why investors are watching closely.

Quick Overview: Pelosi’s 2025 Portfolio Highlights

| Stock | Action | Date | Amount | Return Since Trade |

|---|---|---|---|---|

| Tempus AI (TEM) | Buy | Jan 14, 2025 | $50K–$100K | +97.24% |

| NVIDIA (NVDA) | Buy/Sell | Jan 2025 | $1M–$5M (each) | +3.02% |

| Palo Alto Networks (PANW) | Buy | Dec 20, 2024 | $1M–$5M | +3.02% |

| Vistra Corp (VST) | Buy | Jan 14, 2025 | $500K–$1M | +8% |

| Broadcom (AVGO) | Buy | June 2024 | $1M–$5M | +25% |

Pelosi’s 2025 Stock Strategy: AI and Tech at the Core

Nancy Pelosi’s 2025 trades reveal a clear focus on artificial intelligence and technology.

Her investments in companies like Tempus AI, NVIDIA, and Broadcom align with the growing AI trend.

Key Moves:

- Tempus AI (TEM):

Pelosi purchased 50 call options with a $20 strike price, expiring in January 2026.

Following this, Tempus AI’s stock surged by over 97%, reflecting strong market confidence in AI-driven healthcare solutions. - NVIDIA (NVDA):

Multiple transactions in January 2025, including both buys and sells ranging from $250K to $5M, indicate active engagement with this leading AI chipmaker. - Palo Alto Networks (PANW):

A significant buy of $1M–$5M in December 2024 showcases interest in cybersecurity, a sector increasingly intertwined with AI. - Vistra Corp (VST):

A $500K–$1M investment in this energy provider reflects diversification, with Vistra’s focus on powering data centers for AI applications. - Broadcom (AVGO):

A substantial purchase in June 2024 aligns with Broadcom’s strong performance in AI-related semiconductor solutions.

Pelosi’s Portfolio Performance vs. Market Benchmarks

| Metric | Pelosi’s Portfolio | S&P 500 |

|---|---|---|

| 2024 Annual Return | +54% | +24% |

| Return Since May 2014 | +700% | +230% |

| 2025 YTD (as of June) | +19.72% | +8.5% |

Pelosi’s portfolio has consistently outperformed the market, with a notable 54% return in 2024 and a 19.72% gain in early 2025.

Legislative Spotlight: The PELOSI Act

In response to concerns over congressional stock trading, Senator Josh Hawley reintroduced the Preventing Elected Leaders from Owning Securities and Investments (PELOSI) Act in early 2025.

This legislation aims to prohibit lawmakers and their spouses from trading individual stocks, requiring divestment or placement into blind trusts.

The “Pelosi Effect” on Stocks

Pelosi’s trades often lead to increased investor interest, a phenomenon dubbed the “Pelosi Effect.”

For instance, after her investment in Tempus AI was disclosed, the stock experienced a significant surge, highlighting the influence of her trading activities on market dynamics.

Looking Ahead: What Pelosi’s Trades Suggest

Pelosi’s investment patterns indicate a strong belief in the future of AI and technology sectors.

Her strategic moves in companies like Tempus AI and Broadcom suggest confidence in the continued growth of AI applications across industries.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.