Discover how fast invoice factoring helps small businesses in the USA improve cash flow quickly. Learn the process, benefits, and real-world impact in simple words.

Running a small business is tough, especially when you’re waiting on unpaid invoices while expenses keep piling up. That’s where invoice factoring comes in — a simple and fast solution to turn your invoices into cash. Let’s break it down.

What Is Invoice Factoring?

Invoice factoring is a financial service where a business sells its unpaid invoices (accounts receivable) to a third-party company (called a factoring company) in exchange for immediate cash.

You get up to 80%-90% of the invoice value upfront, and the factoring company collects the payment directly from your customer.

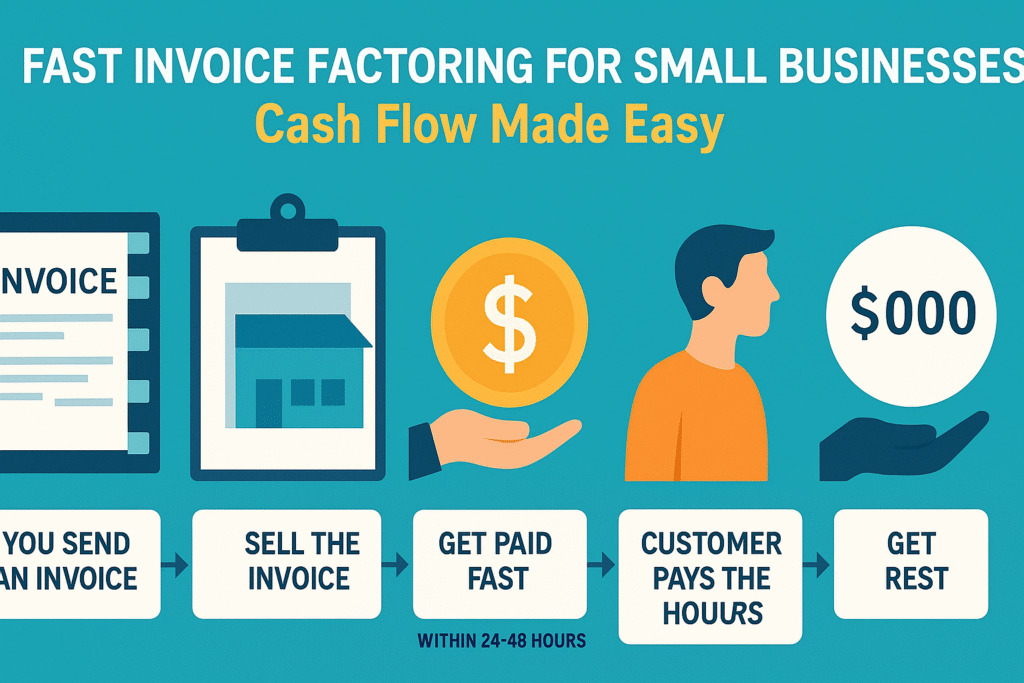

How Invoice Factoring Works: Step-by-Step

| Step | Action | Details |

|---|---|---|

| 1 | You send an invoice | Business issues an invoice to a customer |

| 2 | Sell the invoice | Submit the invoice to a factoring company |

| 3 | Get paid fast | You receive most of the invoice value within 24–48 hours |

| 4 | Customer pays the factor | Customer pays the full invoice to the factoring company |

| 5 | Get the rest | After payment, you receive the remaining balance (minus fees) |

Types of Invoice Factoring

| Type | Description |

|---|---|

| Recourse Factoring | You take responsibility if the customer doesn’t pay |

| Non-Recourse Factoring | The factor takes on the risk of non-payment |

| Spot Factoring | Factor only one or a few invoices |

| Whole Ledger Factoring | Factor your entire receivables book regularly |

Benefits of Invoice Factoring for Small Businesses

1. Fast Cash Flow

You no longer have to wait 30, 60, or 90 days for payments.

2. Easy Approval

Approval is based on your customer’s credit — not yours.

3. No Collateral Needed

Unlike loans, factoring doesn’t need assets as security.

4. Outsourced Collections

The factoring company handles collecting payment from your customer.

5. Business Growth

Use the cash to buy inventory, hire staff, or invest in marketing.

How Invoice Factoring Impacts Small Businesses in the USA

Historical Perspective

| Year | Invoice Factoring Volume (USA) |

|---|---|

| 2015 | $80 billion |

| 2018 | $100 billion |

| 2022 | $130 billion |

| 2024 | $150 billion (estimated) |

The factoring industry is growing, especially among startups and small business owners who prefer flexible cash flow tools over traditional loans.

Factoring vs. Business Loans

| Criteria | Invoice Factoring | Bank Loan |

|---|---|---|

| Speed | 1–3 days | 1–3 weeks |

| Collateral | Not required | Often required |

| Based On | Customer’s credit | Your credit & assets |

| Repayment | Paid by customer | Monthly EMIs |

| Flexibility | High | Low |

Common Myths About Invoice Factoring

Myth 1: It’s only for struggling businesses

Fact: Even healthy companies use factoring to manage growth.

Myth 2: Customers will be unhappy

Fact: Reputable factors handle collections professionally.

Myth 3: It’s too expensive

Fact: If you factor wisely, the ROI outweighs the cost.

Choosing the Right Factoring Company

| Factor Criteria | What to Check |

|---|---|

| Experience | At least 5+ years in your industry |

| Fees | Transparent, with no hidden charges |

| Contract Terms | Flexible exit options |

| Advance Rate | 80% or higher preferred |

| Support | 24/7 customer service is a bonus |

Future of Invoice Factoring in the USA (2025–2030)

- Digital platforms are making factoring faster and more transparent.

- AI-based risk scoring will improve approval speed and accuracy.

- More industries (like SaaS, eCommerce) are starting to use it.

- The total market is projected to reach $200B by 2030 in the U.S.

Conclusion

If you’re a small business owner looking for fast funding without the stress of loans or debt, invoice factoring might be your best tool. It keeps your cash flowing, your business running, and your focus on growth — not collections.

Stay cash-ready. Stay focused. Choose factoring.